top of page

Smart by Design, or Flaw in the Design?

Why the same private credit loan is different on a bank’s or insurer’s balance sheet Introduction Since I started exploring partnerships between banks and insurers, I have been intrigued by the question: “how can a loan, with a certain economic risk profile, have a very different capital charge on a bank’s or an insurer’s balance sheet, and is this capital arbitrage, or not?” Over the years, I have had many discussions with colleagues on this topic and more recently, I have r

Danny Dieleman

Dec 15, 202513 min read

Two Faces of Prudence: Why IFRS 9 Overlays and CRR Ill MoCs Are Similar, Different - and Often Misunderstood

The strong reaction to recent discussions around IFS 9 overlays and CRR Ill Margins of Conservatism (MoC) highlights how easy it is to conflate these two adjustment mechanisms. Both arise when models face uncertainty, data gaps, or limitations. Both have the effect of moving estimates away from "pure" model output. And both are seen by stakeholders as adding prudence. Yet beneath this surface similarity lie important differences in purpose, direction, and governance. Misunder

Ozan Çağlar

Dec 5, 20253 min read

Crypto’s great comeback: And why the banks should now join the party

Executive summary The regulatory breakthrough that changes everything After years of institutional exile, cryptocurrency and stablecoins are poised for mainstream adoption by traditional banks. This is driven by a fundamental shift in the U.S. and global regulatory frameworks. The problem: prohibitive cost of capital Basel Committee capital rules imposed a punitive 1,250% risk weighting on crypto assets, making them economically impossible for banks. A simple example: a $1 mi

Pierre Pourquery

Dec 2, 202510 min read

A Turning Point for Building Societies

The regulatory environment for UK building societies is undergoing a significant shift. The Prudential Regulation Authority (PRA) is progressing toward the phased implementation of its Strong and Simple Regime (SSR) from 2026. The SSR is designed to simplify prudential requirements for small domestic deposit takers (SDDTs), thereby providing simplified liquidity and disclosure requirements for eligible building societies. Also, the PRA is set to withdraw Supervisory Statement

Sreekanth Mangulam & Anshuman Prasad

Nov 27, 20255 min read

Global Banks are Adopting Standardised CVA over IMA-CVA

C ontents Introduction About CVA and SA-CVA Benefits of SA-CVA Challenges with IMA-CVA Approach for Banks Summary References Introduction CVA reflects the market value of counterparty credit risks, the expected loss if a counterparty defaults. The rise in CVA-related capital for global banks stems from new regulations and increasing derivatives complexity. CVA assesses counterparty risk for OTC derivatives. Basel’s new rules replace prior methods with SA-CVA and BA-CVA, remov

Ravi Bhushan

Nov 25, 20257 min read

Blockchain Transformation in Finance: A Case Study of Digital Asset Platform (DAP)

Abstract: Digital Asset Platform (DAP) represents a landmark transformation in capital markets. The strategic rationale behind DAP is to automate and digitize the entire asset lifecycle, from issuance through trading, settlement, and custody, by employing a permissioned blockchain, Daml Smart Contracts, and cloud-native architecture. This transformation results in faster settlement, eliminates manual reconciliation, enhances transparency, and enables real-time compliance, a

ASHISH KUMAR

Nov 19, 202526 min read

Why Europe's Securitization Market Falls Short - and How to Fix it

Introduction Securitizations help European banks lend more. They allow banks to move the credit risks of loans off their balance sheets and use the freed-up capital to support new lending. But since the Global Financial Crisis (“GFC”), securitization volumes in Europe have dropped significantly, while in contrast, the U.S. market has grown, even though U.S. defaults peaked during the GFC. To address this, the EU Commission is reviewing how securitization works in the EU. This

Danny Dieleman

Nov 10, 20256 min read

🎃 Haunted Model Risk Issues: When Models Come Back to Haunt You

It’s Halloween night in the world of AI and Risk. The lights are dim in the data center, but something is stirring deep within the systems — models that should have been retired long ago whisper back to life. Their logs flicker with activity, unexplained trades appear in audit trails, and risk dashboards pulse with ghostly data points. No, this isn’t a scene from a sci-fi thriller. It’s what happens when model risk management lapses , when biases are left unchecked , and when

Ghost Writer

Oct 29, 20254 min read

Bank Asset – Liability Management Approach in times of Extreme Uncertainty: A Guide for ALCO Chairs

WHITEPAPER Today banks are operating under heightened uncertainty. Since early 2025, global markets have experienced considerable volatility, driven by unpredictable policy directions and rapidly shifting economic indicators. This has been reflected in pronounced movements across equity markets and widening spreads in both short and long-term interest rates. One notable development has been the sharp increase in 10-year US Treasury yields following major policy announcements.

Bharadwaj Vishnubhotla & Moorad Choudhry

Oct 21, 20253 min read

The Transformative Power of AI in Market Risk and FRTB

Global banks face immense pressure to align daily risk calculations with constantly evolving FRTB mandates and to transform market risk...

Ravi Bhushan

Sep 4, 202510 min read

CSRBB – Increasing Focus on Banking Book and Capital

Contents CSRBB Product Scope – Banking Book . Aligning CSRBB Methodologies . CSRBB Risk Assessment Methods . CSSRBB Vs IRRBB – Holistic View . Challenges faced by banks in incorporating CSRBB as Pillar II risk . Best Practices for Managing CSRBB Regulatory Compliance . Conclusion . References . Incorporating CSRBB into Pillar II Risk and Capital Requirements Managing credit spread risk in the banking book (CSRBB) is crucial for effective risk management, especially given the

Ravi Bhushan

Jul 21, 202511 min read

Geopolitics, Financial Crime, and the AI Revolution: The New Battlefield for Financial Services

The intersection of geopolitics, large scale economic crime, and artificial intelligence (AI) is rapidly reshaping the global financial...

Yair Samban

Jul 17, 20257 min read

Understanding and Mitigating Algorithmic Bias: A Comprehensive Guide

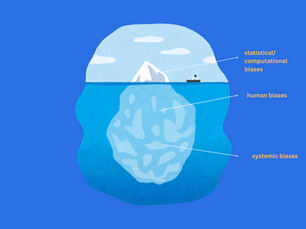

According to Britannica, bias is a tendency to believe that some people, ideas, etc., are better than others, which usually results in...

Ayşegül Güzel

Jul 3, 20259 min read

Navigating the AI Frontier: Risk, Responsibility, and Resilience in a Rapidly Evolving Landscape

As artificial intelligence continues to transform industries, economies, and global systems, it brings with it immense opportunities—and...

Mariusz (Mario) Dworniczak, PMP

May 25, 20255 min read

Global Banks' Dilemma over FRTB IMA vs SA Implementation

Global banks are grappling with the trade-offs between FRTB IMA and SA approaches. As deadlines for the Fundamental Review of the Trading Book (FRTB) draw nearer across many jurisdictions, debates around using the Internal Models Approach (IMA) versus the Standardised Approach (SA) are intensifying. The decision is not straightforward. In this article, we examine the pros and cons of each approach and discuss how market participants are addressing this challenge. Ba

Ravi Bhushan

May 21, 202511 min read

Quant Risk and Regulations - a potpourri of multiple disciplines

Mid-90s witnessed the influx of Physics and Maths PhDs to Wall Street in large number. The likes of Goldman, Merrill Lynch and Morgan Stanley would make beelines to the pristine campuses of Columbia, Harvard and Wharton to hire their Quant PhDs as associates to do the complex Maths behind Derivative models. Many of the academically oriented quants (Maths and Physics PhDs) decided to take a shot at this new-found career option with the I-banks to try out what they learnt in

Diganta Saikia

May 15, 20254 min read

Replicating Portfolios in Banking: A Literature Review on Asset-Liability Management, Interest Rate Risk, Liquidity Risk, and Funds Transfer Pricing

Banks face significant challenges in managing liabilities without contractual maturities—such as demand deposits and savings accounts—due...

Chih Chen

May 8, 20255 min read

The Future of Risk: Emerging Themes in Reinsurance

The reinsurance sector is undergoing a structural transformation as it grapples with an increasingly complex and interconnected global...

David Withnell

Apr 21, 20255 min read

Algorithmic Risk and Impact Assessment: A Crucial Step Toward an Ethical Approach to AI

Today I want to talk about one of the basics in the AI Governance world: Algorithmic Risk Assessments. As the EU AI Act is starting to...

Ayşegül Güzel

Apr 14, 20256 min read

bottom of page